Chairman's Interim Statement

Ocean Wilsons Holdings Limited is the majority shareholder in Wilson Sons Limited "Wilson Sons" and holds a portfolio of

international investments. Wilson Sons is listed on the Luxembourg and Brazilian Stock Exchanges and is one of Brazil's

largest providers of integrated port and maritime logistics and supply chain solutions.

Results

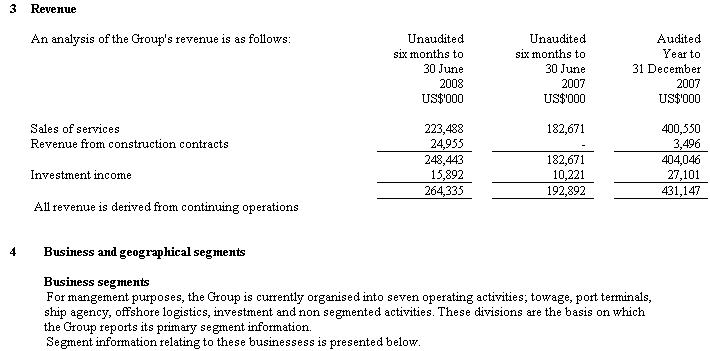

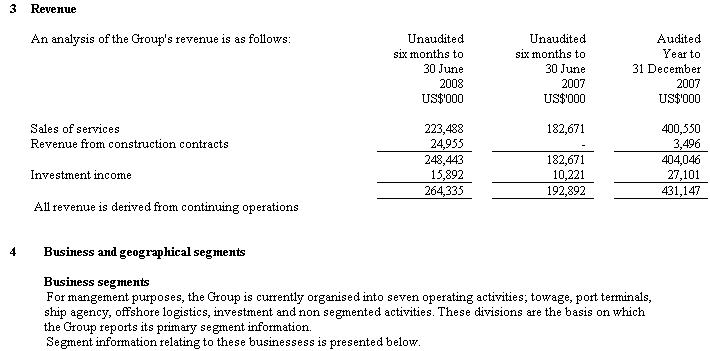

Ocean Wilsons Holdings Limited has produced another strong financial and operational performance. Group revenue for the

six months ended 30 June 2008 was up 36% at US$ 248.4 million (2007: US$ 182.7 million) driven by increases in our core

businesses and the expansion of our vessel construction business

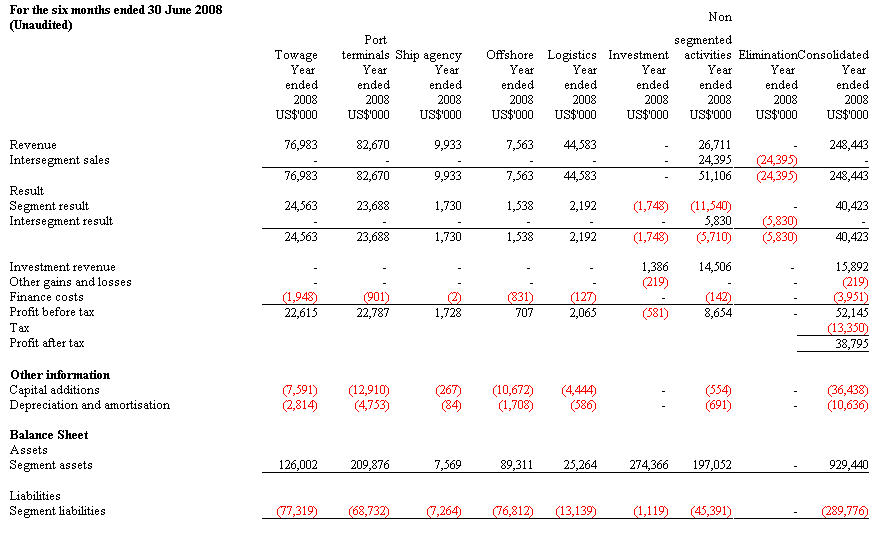

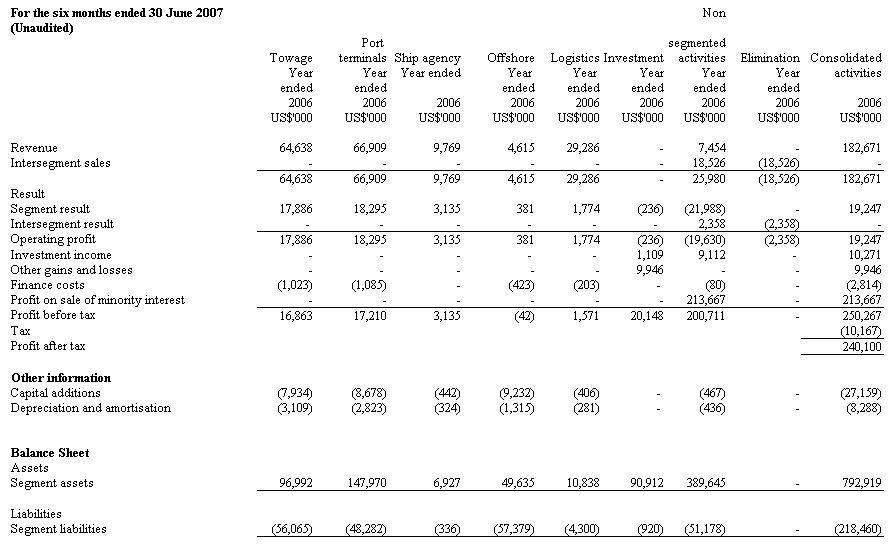

Group operating profit increased US$ 21.2million to US$40.4 million (2007: US$ 19.2 million) due principally to the strong growth

in revenue, improved operating margins in towage port operations and offshore as well as lower share based payment expense,

US$ 1.8 million (2007:US$ 7.8 million). Operating margins were positively impacted by favourable pricing, lower tug rentals,

reversal in the provisions for doubtful debts (US$ 1.9 million) and fiscal credits (US $3.7 million). The lower share based payment

expense in 2008 is principally due to a fall in the Wilson Sons share price and the 2007 charge includes additional retrospective

accruals that crystallised on the implementation of the Ocean Wilsons Holdings Limited scheme.

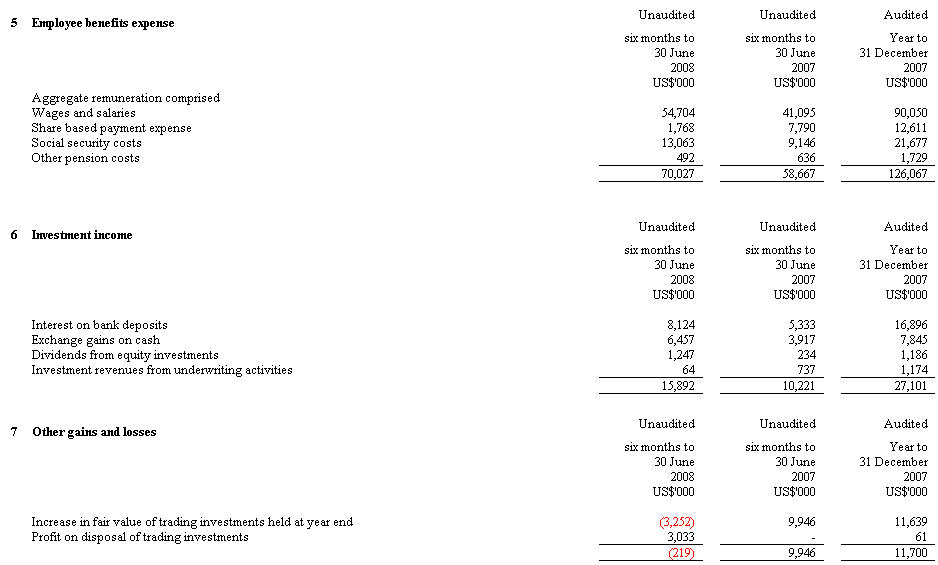

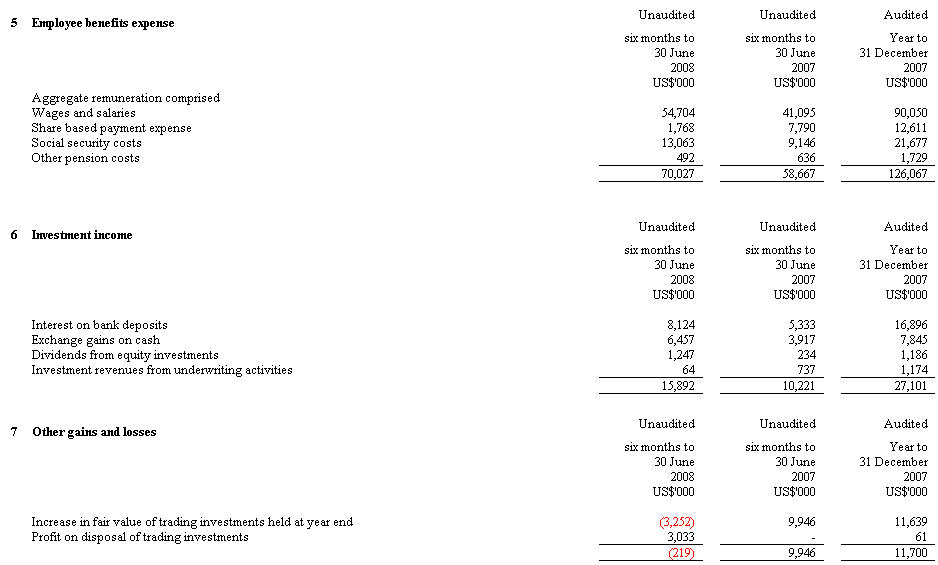

Investment revenues in the period increased by US$ 5.7 million to US$ 15.9 million (2007: US$ 10.2 million), principally due to

higher interest receipts from bank deposits and exchange gains on cash and cash equivalents. The higher interest receipts

resulted from higher average cash balances during the period compared with 2007.

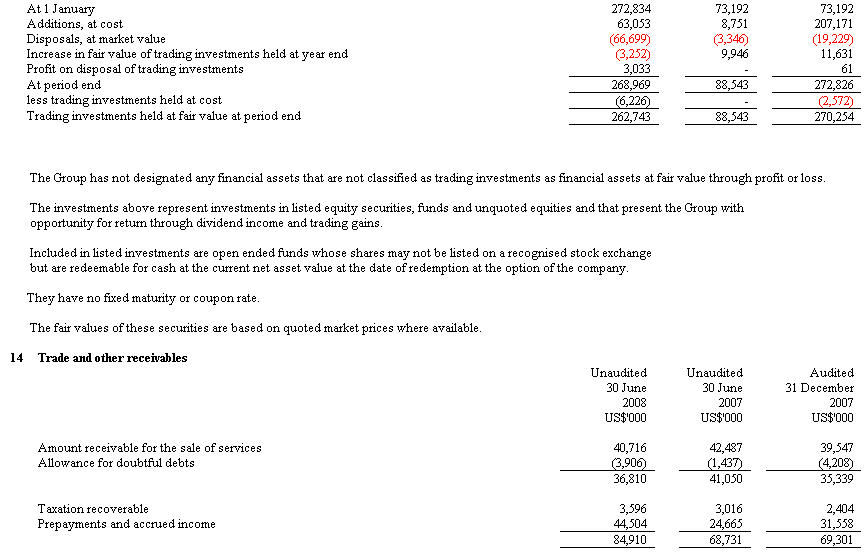

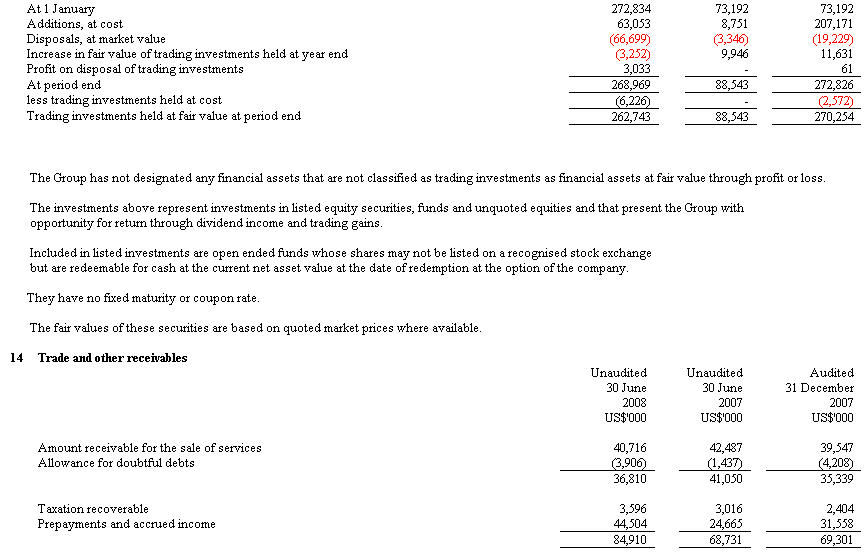

Other losses of US$ 0.2 million (2007: US$ 9.9 million gain) arose from the Group's portfolio of trading investments and comprise

decreases in the fair value of trading investments held at period end and profits on the disposal of trading investments.

Finance costs for the period increased US$ 1.1 million to US$ 3.9 million (2007: US$ 2.8 million) principally due to increased

interest on bank overdrafts and loans and higher other interest charges.

Profit before tax fell US$ 198.1 million to US$ 52.1 million (2007: US$ 250.3 million) as the 2007 results included the profit on the

sale of minority interest of US$ 213.7 million from the IPO of Wilson Sons Limited. Removing the Wilson Sons IPO profit from the

2007 result, the comparative profit before tax for 2007 would be US$ 36.6 million.

The lower Profit before tax is reflected in lower earnings per share based on ordinary activities after taxation and minority

interests of 63.5 cents (2007: 669.5 cents).

Wilson Sons Limited Initial Public Offer (IPO)

On the 30 April 2007, Ocean Wilsons Holdings Limited, ("Ocean Wilsons or the Company") successfully floated Wilson Sons, the

holding company of its Brazilian business, on the Sao Paulo Stock Exchange and the Luxembourg Stock Exchange. The flotation

involved the sale of 18.7 million shares by Ocean Wilsons, resulting in net proceeds to the Company of approximately US$205.6

million, and the issue of 11 million new shares by Wilson Sons, raising approximately US$119.1 million for Wilson Sons.

Following the flotation, Ocean Wilsons retained a 58.25% holding in Wilson Sons. The Company continues to fully consolidate Wilson

Sons in its accounts with a 41.75% minority interest. At the close of business on the 8th August the Wilson Sons share price was

Real 18.50 resulting in a market value for the Ocean Wilsons holding of 41,444,000 shares in Wilson Sons of approximately

US$ 476 million which is equivalent to US$ 13.47 per Ocean Wilsons share.

Exchange rates

In the six months to 30 June 2008 the Real appreciated 10.1% against the US Dollar from 1.77 at 1 January 2008 to 1.59 at the

period end. The appreciation of the Real against the US Dollar generated a net exchange gain of US$ 6.5 million (US$3.9 million)

on the Group's Real-denominated cash balances in the period. The appreciation of the Real also had an adverse affect on our Real

denominated costs when converted into US Dollars which effects operating margins.

Dividend

The Board has declared an interim dividend of 4.0 cents per share (2007: 4.0 cents per share) to be paid on 26 September 2008

to shareholders on the register at close of business on 29 August 2008.

Dividend Policy

Dividends are set in US Dollars and paid twice yearly. Shareholders receive dividends in Sterling by reference to the exchange

rate applicable to the US Dollar on the dividend record date, except for those shareholders that elect to receive dividends in US

Dollars.

The Company's target dividend payout in respect of each financial year is to pay the Company's full dividend received from Wilson

Sons in the period plus a percentage of the average capital employed in the investment portfolio including cash under management

to be determined annually by the Board.

Your Board of Directors may review and amend the dividend policy from time to time in light of our future plans and other factors.

The payment of dividends cannot be guaranteed and may be discontinued or varied at the discretion of the Board.

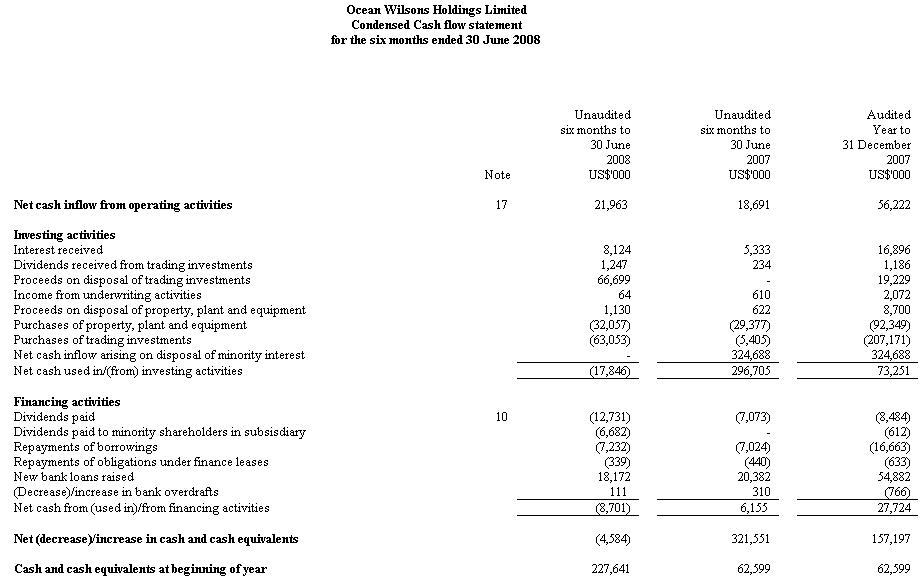

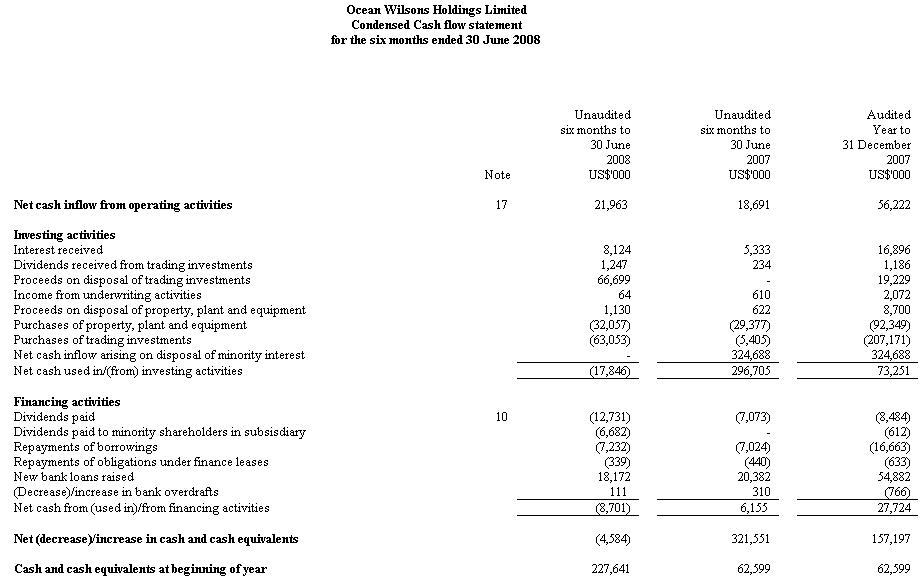

Cash flow and debt

Net cash inflow from operating activities was US$ 22.0 million in the first six months of 2008 compared with US$ 18.7 million in

the same period last year. The higher operating profit in the period of US$ 40.4 million (2007: US$ 19.2 million) was partially

offset by adverse working capital movements and a decrease in non-cash expenses. (Share based payment expense, US$ 1.8

million, 2007: US$ 7.8 million).

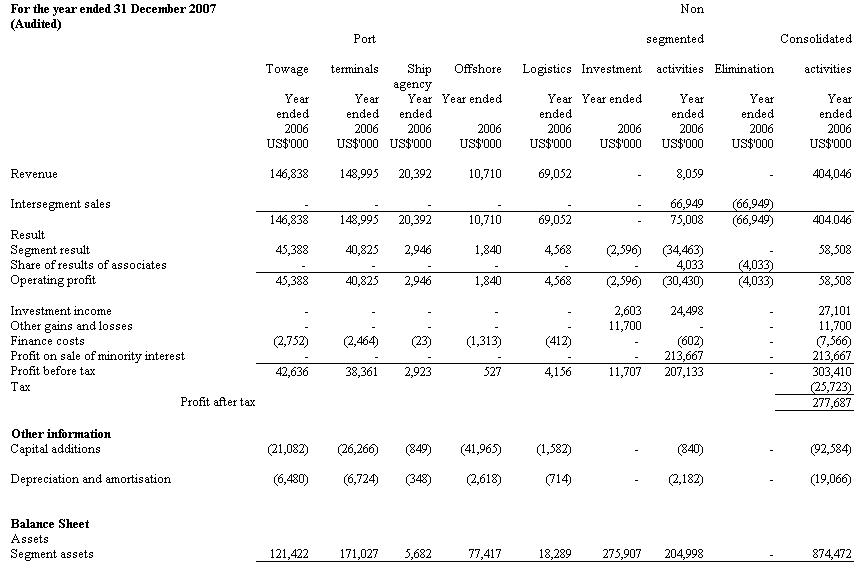

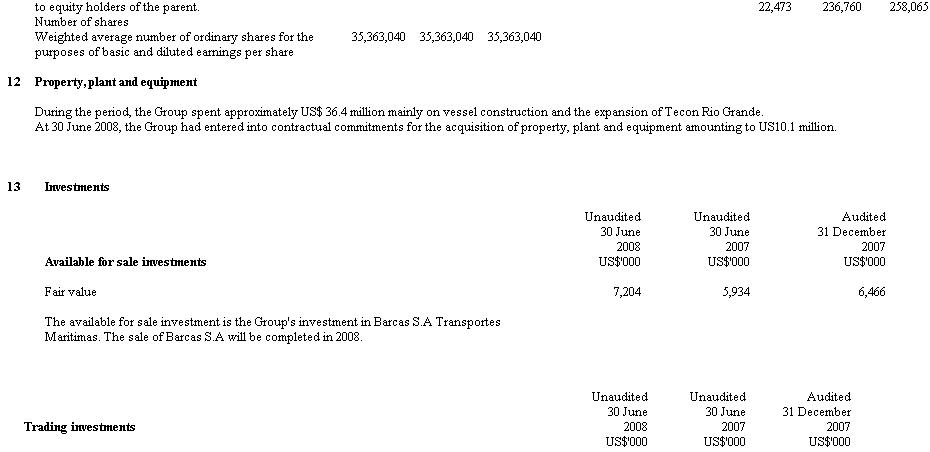

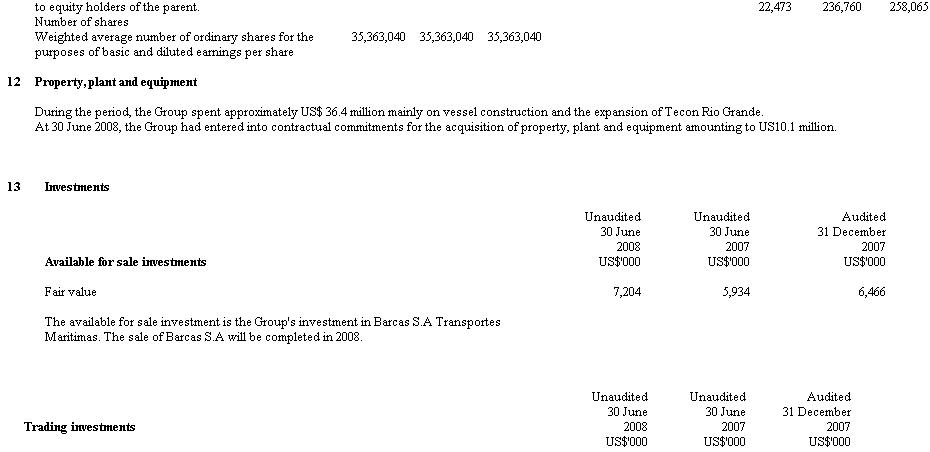

Capital expenditure in the period amounted to US$36.4 million (2007: US$ 27.2 million). The major elements were the expansion

of Tecon Rio Grande, equipment for Tecon Salvador, the towage fleet renewal program and offshore vessel construction.

The Group's fourth Platform Supply Vessel (PSV), Pelicano was launched in May 2008.

Net cash outflow during the period was US$4.6 million (2007: US$321.6 million inflow). The large inflow in 2007 was principally

due to the disposal of the minority interest in Wilson Sons, (US$ 324.7 million inflow).

Group borrowings increased US$ 12.0 million at 30 June 2008 to US$161.5 million. Additional funds were released by the BNDES

and IFC, to finance vessel construction and equipment for Tecon Salvador. During the period the Group made capital repayments

on existing loans in accordance with repayment schedules of US$ 7.2 million

At 30 June 2008 the Company and its subsidiaries had US$229.5 million in cash and cash equivalents (31 December 2007:

US$227.6 million). In addition at the balance sheet date the investment portfolio included US$120.1 million in liquidity funds.

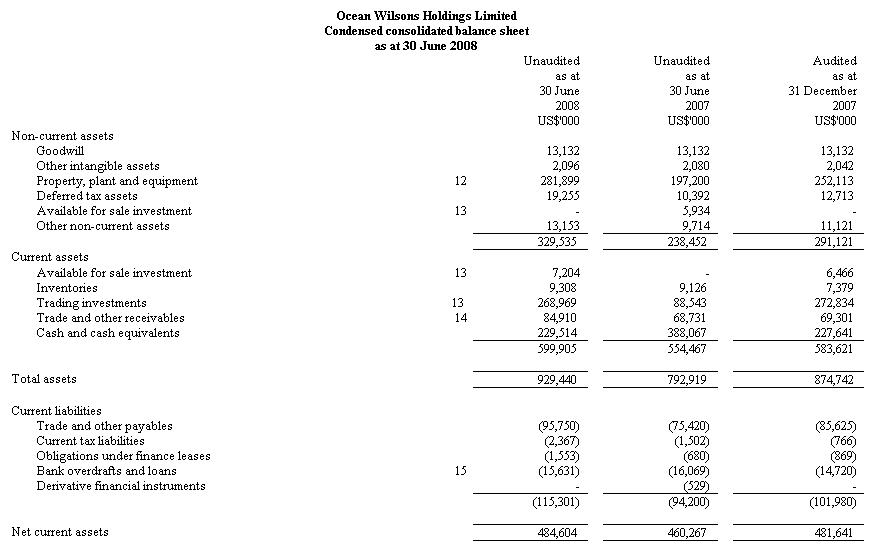

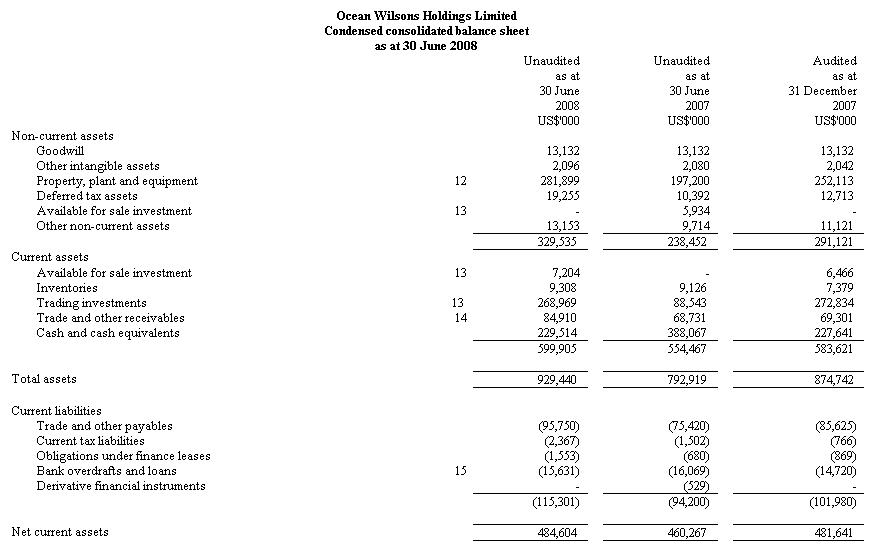

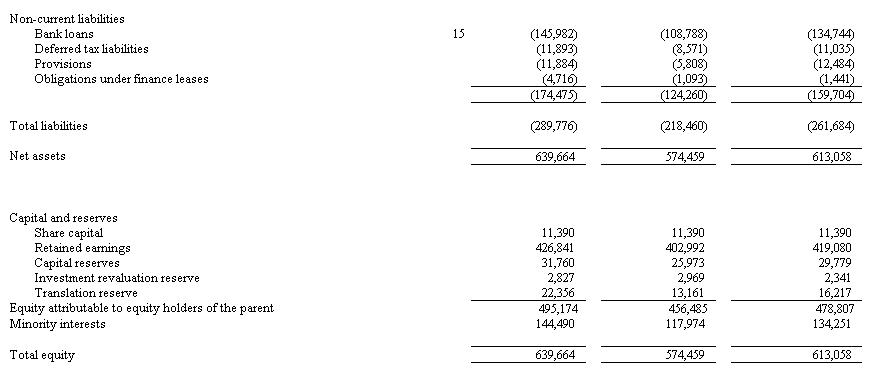

Balance sheet

At 30 June 2008, the Company's consolidated net assets (excluding minority interests) amounted to US$ 495.2 million (31

December 2007: US$ 478.8 million). This is the equivalent of US$ 14.00 per share (31 December 2007: US$ 13.54). Of this,

trading investments of US$ 269.0 million equates to US$7.61 per share. Minority interests increased US$10.2 million to

US$ 144.5 million at period end.

At 30 June 2008 the investment portfolio including cash under management amounted to US$272 million. This is the equivalent

of US$ 7.70 per share.

Wilson Sons Limited operating review

We have summarised the following highlights from the Wilson Sons 2nd quarter 2008 earnings results released on 11 August 2008.

The full report is available on the Wilson Sons Limited website: www.wilsonsons.com:

Strong Earnings performance

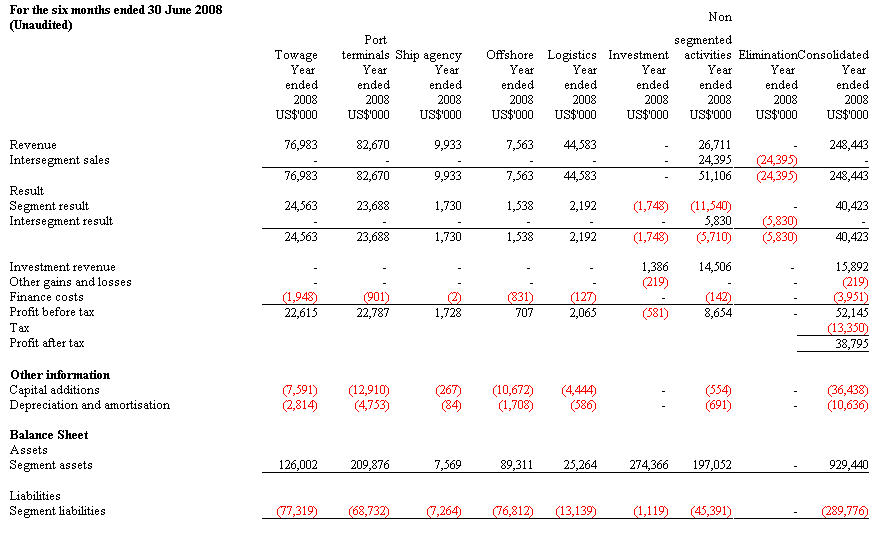

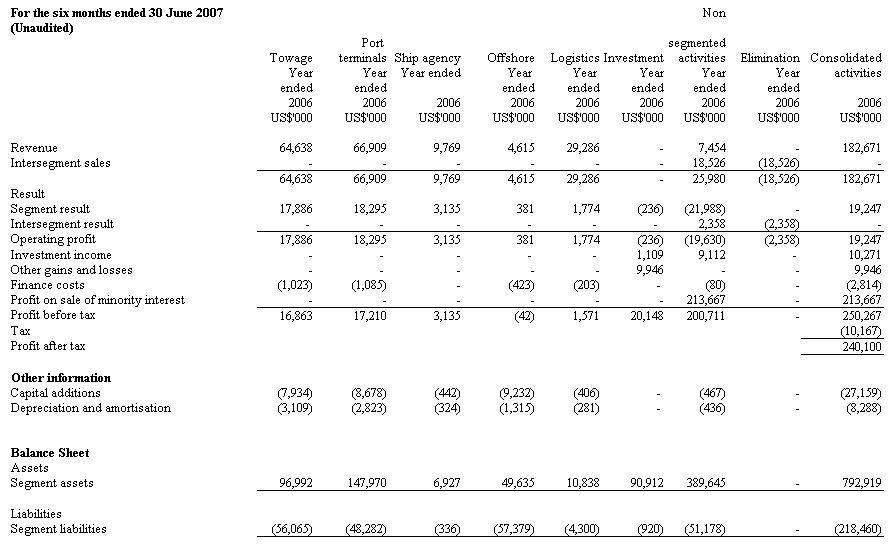

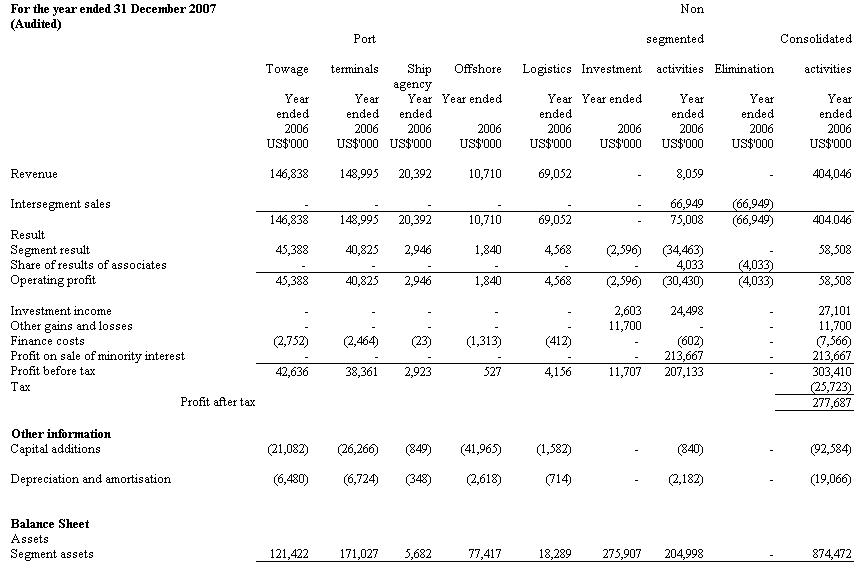

For the six months to 30 June 2008 Wilson Sons reported strong earnings results across its leading business segments.

Consolidated revenues grew by 36% and EBITDA (Earnings before interest, tax, depreciation and amortisation) reached

US$ 52.6 million, a 49% increase over the same period in 2007. Our overall positive performance supports our optimistic view

of Wilson Sons' integrated business model, despite the challenging environment of a weakening US Dollar, (the "Real", has

appreciated 16% against the US Dollar since 30 June 2007), and rising inflation.

A positive outlook going forward

Wilson, Sons is determined to take advantage of its main growth drivers. The combination of financial health and opportunities

arising from increased trade flows, stable macroeconomic fundamentals in Brazil and a booming oil and gas industry, position us

to grow while taking advantage of our IPO proceeds and available funding opportunities.

Going forward, we intend to expand our shipyard, which will allow us to take advantage of opportunities in the offshore oil and

gas and towage industries. The expanded shipyard will provide additional capacity to build new offshore support vessels, compete

in the new Petrobras public tenders, and explore opportunities arising in the spot market for oil supply vessels (OSVs). We intend

to deliver at least one new tugboat and one platform supply vessel (PSV) by the end of the year.

As part of our tugboat fleet renewal programme, we intend to build more powerful tugboats to attend higher deadweight vessels

and improve margins, and offer alternative solutions for the support of oil platform offloading activities.

We are set to expand our container terminal capacity and continue to assess new terminal projects, both domestically and within

South America. Our logistics business is seeking to broaden its portfolio of clients and to improve margins and accelerate growth.

Port Terminals

Our port terminals business includes two container terminals in Brazil (Tecon Rio Grande and Tecon Salvador), offering assistance

in port operations for loading and unloading of vessels, storage, and auxiliary services. We also operate Brasco, a terminal in Rio

de Janeiro which provides support services for the oil and gas industry.

Revenue

Revenue increased 24% compared to 2007 to US$44.8 million, benefiting from a recovery in tariffs, increased warehousing activity

and improved sales mix. The positive impact from the type of container traffic handled in the period (full deep sea) compensated

for the lower volumes handled. Warehousing-related services generated higher revenues, due to increased imports in the period

and delayed cargo clearance from the terminals due to industrial action by the Customs and Excise officers. Growth in cabotage

services positively impacted results.

EBITDA

Although Brazilian exports in the period were adversely affected by the weakening US Dollar, volumes of full containers handled

were in line with 2007. The reduction in total container volumes handled was attributable to a fall in lower margin empty container

movements. EBITDA for the period at US$28.4 million also benefited from the increased revenue and fiscal credits.

Outlook going forward

Capacity at Tecon Rio Grande will increase by 60% in the second half of 2008. All necessary equipment is in place and ready to

start operations, including gantry cranes and RTGs (rubber tire gantry). The challenge we now face is to implement our strategy

to expand capacity at our Salvador terminal and to improve our equipment and infrastructure, so as to take advantage of market

growth prospects in the northeastern region of the country.

Towage

Wilson Sons offers harbour towage, ocean towage, salvage support and maritime support to the offshore oil and gas industry.

Revenue

Net revenues improved 19% to US$77.0 million in the period, mainly due to higher tariffs, a better sales mix in harbour towage,

higher average deadweight of vessels attended and an increase in the number of special operations (Offshore support, salvage

and ocean towage).

EBITDA

The combination of a successfully implemented pricing strategy and increase in higher margin business (special operations)

positively impacted margins in the period. EBITDA rose 30% to US$ 27.4 million in 2008 from US$ 21.0 million in 2007. We

recovered US$900,000 of doubtful debts in the period and fiscal credits of US$ 1.6 million also contributed to the improvement

in margins.

Removing the effects of the contingency provisions and fiscal credit, EBITDA would have been US$ 24.9 million, 19% higher

than the comparable 2007 figure.

Outlook going forward

We intend to continue to take advantage of the premium prices available in the offshore oil & gas spot market, using the

tug-boats Volans and Aquarius.

Logistics

We provide solutions for our customers' supply chain and product distribution, including general services in storage, bonded

warehousing, distribution systems, road & multimodal transportation, and Non Vessel Operating Common Carrier ("NVOCC").

Revenues

Revenues increased 52% to US$ 44.6 million in the period principally due to the appreciation of the Real against the US Dollar,

new operations and increased revenue from EADI Santo André (our bonded terminal). As the majority of Logistics revenue is

Real denominated, any appreciation of the Real against the US Dollar increases revenue in US Dollar terms. Our bonded terminal

in Santo André (EADI) contributed through higher import and storage volumes.

EBITDA

EBITDA at US$2.8 million was in line with 2007.

Outlook going forward

New and strategic operations are beginning in the second semester of 2008. We anticipate improved margins and profitability,

in the near to medium term as new businesses mature.

Shipping Agency

Wilson Sons acts as the ship-owners representative as well as providing ship agency, commercial representation, cargo

documentation and container control for ship-owners

Revenues

Revenue at US$9.9 million was in line with the same period in 2007. A 10% increase in the number of vessels calls attended

by the ship agency division was offset by a decrease in the number of containers controlled.

To reduce our exposure to foreign exchange rate movements, we further aligned revenue with costs during the period by

repricing some agency fees in Real that were previously denominated in US Dollars. The Group also increased Bill of Lading

fees in the period.

EBITDA

The weakening US Dollar and higher personnel costs from collective labour agreements adversely impacted margins in the

period. EBITDA at US$1.8 million was 47% lower than the first half 2007.

Outlook going forward

The shipping agency segment faces a challenging business environment. However, we believe that our nationwide presence,

combined with longstanding expertise in operating with both liner and tramp vessels, will contribute to broadening our portfolio

of clients, while focusing on efforts to rebuild margins.

Offshore

Wilson Sons operates platform supply vessels (PSVs), to transport equipment and supplies to and from offshore oil and gas

installations.

Revenues

Net revenue reached US$ 7.6 million in the period helped principally by improved tariffs, the positive impact from a weakening

US Dollar and the start of operations of our fourth PSV, Pelicano in mid-May. The Pelicano is delivering premium daily rates by

operating on a renewable spot contract, in place since May.

EBITDA

EBITDA at US$ 3.2million (2007: US$ 1.7 million) benefited from the improved tariffs and the early delivery to market of the PSV

Pelicano.

Outlook going forward

Our fifth PSV, the Atobá, is expected to be operational by September 2008 and we expect to deliver a further two PSVs by 2010.

The expansion plan at our shipyard in Guaruja allows the Group to compete for additional contracts, including new Petrobras

bids for PSVs and AHTSs (anchor handlers).

Non-segmented activities

Non-segmented activities include shipyard and our joint venture dredging company Dragaport and unallocated corporate costs

Revenues

In late 2007, we initiated construction of four new PSVs for third parties at our shipyard, under a US$ 100.0 million contract.

Net revenues from our non-segmented activities in the period were derived solely from shipyard operations, and amounted to

US$ 26.7 million.

EBITDA

US$ 2.4 million in profit recognized in the period consisted of profits on completed PSVs and partially completed PSVs.

Outlook going forward

Our shipyard is a strategic asset to the Company and plays an important role in the growth of our integrated businesses.

The expansion of our shipyard will allow the Company's to expand its level of activity.

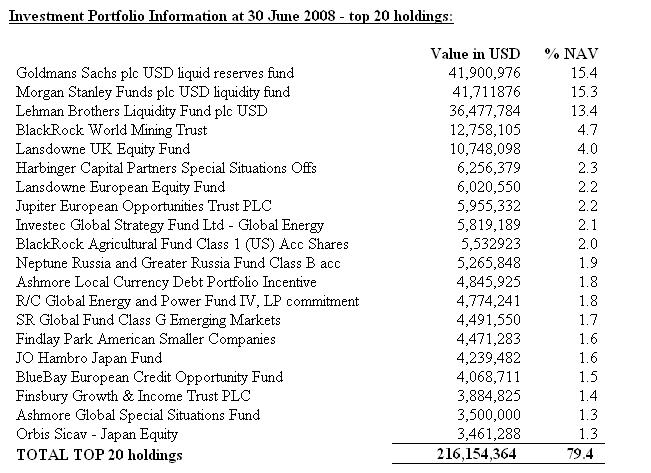

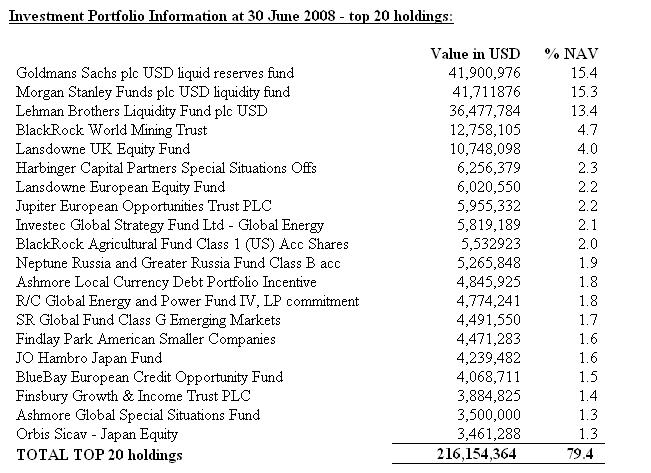

Investment Portfolio

Hanseatic Asset Management LBG that manages the Groups investment portfolio reports at the period end as follows:

Market Background

"The world's share markets suffered sharp declines during the first half of 2008. In US dollar terms the MSCI World Index fell by

10.6% and the MSCI Emerging Market Index by 12.7%. In particular there were dramatic declines in the major emerging

markets of Asia with the Sensex index of Indian equities falling by 39% and the Shanghai A share index for China falling by 45%.

Of the developed markets Continental Europe was particularly weak with the CAC index in France declining by 14.8% and the

DAX index in Germany declining by 14.2%. of the major markets Japan proved the most defensive declining by a relatively

modest 5.5% as measured by MSCI Japan.

In the currency markets there was further weakness in the US dollar which declined by 7.3% against the Euro, 5% against the

Yen and 10.3% against the Brazilian Real. Ten year bond yields for US treasuries declined during the first quarter from 3.5%

to 2.5% but retraced that decline during the second quarter. Yields on 10 year Euro bonds also declined in the first quarter but

then rose to 4.6% having started the year at 4.2%.

In the commodity complex the exponential rise in energy prices continued with a barrel of West Texas Intermediate rising by

45.6%, the copper price rose by a further 31% and an ounce of gold increased by 10.9%. In the agricultural sector there were

some sharp increases with the futures price for corn rising by 51.5%, soybean by 27.5% and rice by 36%.

Two themes dominated the market background during the first half of the year - the escalating credit crisis and its impact on

the financial system and the seemingly relentless rise in the oil price.

The year started with announcements of massive write downs from Citigroup ($18.0bn) and UBS ($18.4bn) as a result of sub

prime losses. Both institutions announced further large write downs in the period and the headlines were dominated by rumours

of troubled institutions and forced bailouts such as Bear Stearns' rescue by JP Morgan with the support of the US Federal Reserve.

Banks sought to shore up battered balance sheets with injections of capital through rights issues. In April the IMF predicted that

the scale of global write downs could reach US$950bn. The Federal Reserve reacted to this deteriorating background with a series

of aggressive cuts in the Federal Funds rate. Consumer confidence plummeted, undermined by falling property prices as real

estate values reflected the crisis in credit.

On its own the "credit crisis" would have been bad enough for equity markets to digest but to complete what commentators have

referred to as a "perfect storm" for financial markets, oil prices continued to confound expectations and move relentlessly to

record highs. A combination of moribund credit (stagnation) and out of control input costs (inflation) creates a toxic background

for investment termed "stagflation". Both the credit crisis and record oil prices can be seen as direct consequences of excessively

accommodative monetary policy since the turn of the century. Energy demand has been a leveraged function of GDP growth in

countries like China and India and domestic subsidy policies have reduced price sensitivity. Ultimately demand will be

constrained implying recession like conditions in developed economies and significantly lower growth in developing ones.

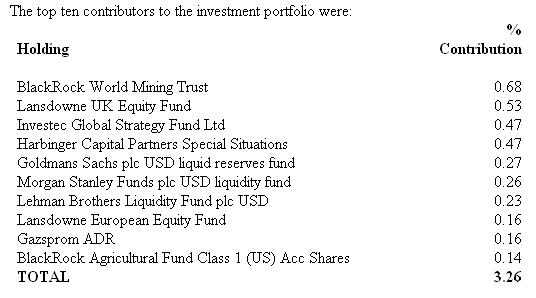

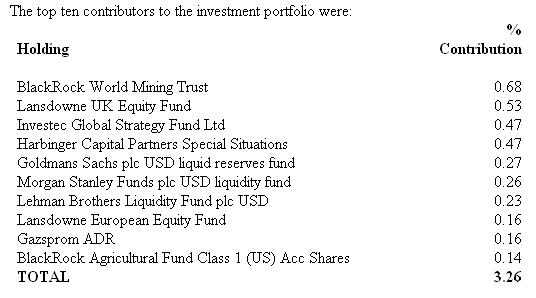

Performance

Against such a negative market background it is relatively reassuring to report that the investment portfolio declined in value

by only 0.26% after deduction of expenses. In part the decision to hold back a substantial portion of liquid reserves from

deployment helped to prevent capital losses. However the invested portfolio performed relatively well, only declining by 2.1%

as opposed to a decline of 10.6% for the MSCI World and 12.7% for the MSCI Emerging Market Index.

The top performing investments were the Harbinger Capital Partners Special Situations Fund LP (+25.1%), Gazprom ADR

(+21.1%), UFG Russia Select (+15.5%) and Lansdowne UK Equity (+15.3%). The Harbinger Fund benefited from long positions

in iron-ore mining, power generation and steel production. Performance on the short side has been through positions related to

the fallout following the sub-prime crisis, including shorts on mortgage and monoline insurers. Both Gazprom and UFG benefited

from favourable energy prices and the improving prospects for the Russian economy. The Lansdowne UK Equity Fund has been

very successful in pursuing a strategy of having long exposure to natural resources and short exposure to the financial sector.

The worst performing area of the portfolio occurred in Asia. Historically the portfolio has had an overweight exposure here

owing to the favourable long term growth prospects for the region. However a combination of higher risk aversion and worries

over rising fuel and food costs generated particularly severe setbacks in several of the Asian markets.

Overall, a combination of broad diversification and added value at the individual security selection level generated good relative

performance.

Portfolio Activity

At the beginning of the year the portfolio had cash of $167.7m available for investment. During the period approximately $46m

of this cash was deployed. Of this approximately $30m were new investments (as opposed to additions to existing holdings).

At the end of June 2008 cash represented 45% of total assets, equities represented 40% with 10% in alternative assets and 5%

in fixed income.

Amongst the significant new positions was Harbinger Capital Partners Special Situations Fund LP which pursues superior absolute

returns through investments in a variety of instruments including distressed and high yield debt, credit default swaps and control

equity stakes in special situations. Harbinger takes long and short positions. Neptune Russia Fund invests in liquid Russian equities.

Russia is clearly a major beneficiary of very high world prices for energy, industrial metals, timber, fertilisers, grains and

precious metals. The domestic economy is booming, appears immune to the credit crisis unfolding internationally and equity

ratings are generally attractive. Riverstone/Carlyle Global Energy and Power Fund IV, LP is a limited partnership with a ten year

life making investments in exploration and production, midstream, oilfield services and power generation and transmission globally.

EFG Hermes Middle East and Developing Africa Fund and BlackRock Middle East and North Africa Opportunities are both vehicles

offering exposure to the burgeoning economic opportunities in the MENA region. The increasing adoption of secular, market based

principles in addressing the economies of this region together with massive budget surpluses accruing from high energy prices

has created investment opportunities in a broad range of sectors.

Other new investments during the period included American Depositary Receipts in Gazprom, Russia's leading energy company.

An initial position was established in Atlantis China with a view to adding during the correction underway in the Chinese market.

Contrarian buying into weakness was also the thinking behind investments in Aberforth Smaller Companies and Jupiter Financial

Opportunities.

As well as these new investments in the portfolio there were a number of additions to existing holdings in order to scale up their

unit size in relation to the enlarged portfolio. These included BlackRock World Mining Trust, BlackRock Agriculture, Investec Global

Energy, Jupiter European Opportunities and Finsbury Income & Growth Trust.

Investment Outlook

Since the end of the reporting period the US Administration has announced a series of measures to safeguard the operations of

Fannie Mae and Freddie Mac, the key mortgage institutions in the US. This commitment to stand by these major financial institutions,

despite the scale of losses and write downs of value that has occurred has put, at least for now, some kind of floor under the

crisis of confidence in the financial sector. The severity and duration of the "credit crisis" has exceeded most commentators

expectations and there may now be a period of respite. Any return to "normality" in the banking system combined with any

setbacks that may occur in oil prices as demand declines would be very welcome by equity markets. In particular some of the

more severely depressed bourses in Asia may rally from oversold levels.

Beyond this however the managers are cautious in their outlook for investment returns. The impact in the real economy of the

contraction in credit together with higher input costs that has already occurred is likely to constrain growth for some time to come.

Furthermore room for manoeuvre on the policy front appears extremely limited. Any further loosening of monetary policy is likely

to be self defeating and cause oil and the other commodities to set new highs to offset excessive paper money creation. Recession

cannot be postponed indefinitely and with property prices declining in the developed world consumer confidence is likely to remain

fragile for some time to come.

The emerging markets will not remain unscathed in this difficult period for the world economy. Some, such as the energy producers

like Russia and the Middle Eastern countries, will continue to benefit from the wealth transfer that is occurring between energy

producers and energy consumers. Cost pressures are likely to be present everywhere and those markets with manufacturing

bases that export to Western consumers will inevitably experience a reduction in demand. However the major themes which have

driven growth in emerging markets - urbanisation, a backlog of infrastructure spending, favourable demographics, competitive

labour costs and the need to diversify economically into value added goods and services - remain in place. They underpin the

long term case for investment in emerging markets.

It will take time for recent economic shocks to be absorbed and for imbalances in the world economy to be corrected. A period

of slower economic activity seems inevitable. Such a period will however generate many opportunities to invest on terms more

favourable to investors than have been the case in recent times. Ocean Wilsons Holdings Limited is well placed with ample cash

at its disposal to exploit such opportunities and generate good returns in the medium term."

Responsibility statement

The Directors confirm that to the best of our knowledge:

(a) the condensed set of financial statements has been prepared in accordance with IAS 34;

(b) the interim management report includes a fair review of the information required by DTR 4.2.7R; and

(c) the interim management report includes a fair review of the information required by DTR 4.2.8R

By order of the Board

Jose Francisco Gouvea Vieira

11 August 2008

This report contains certain forward looking statements with respect of the financial condition and results of Ocean Wilsons

Holdings Limited. These should be treated with caution due to the inherent uncertainties, including both economic and business

risk factors. Nothing in this statement should be construed as a profit forecast.

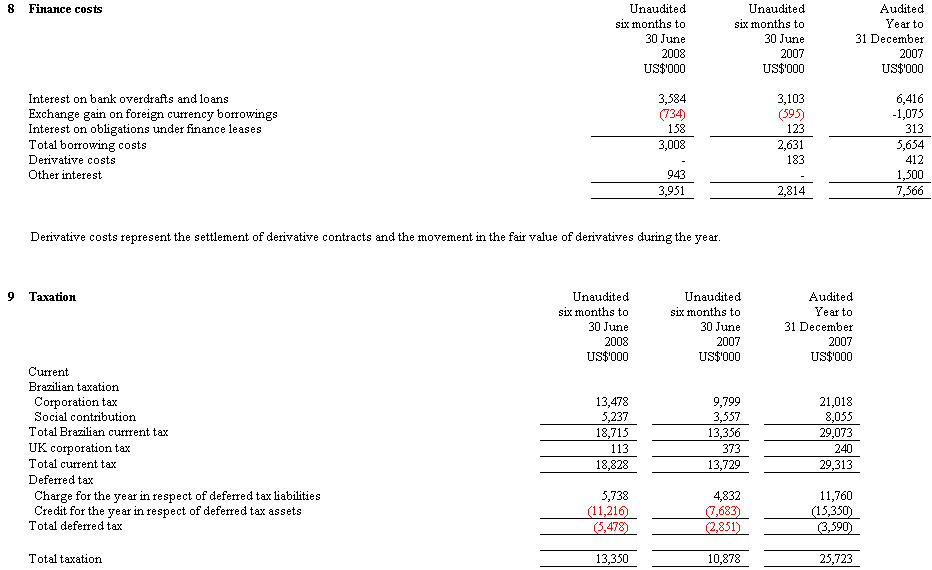

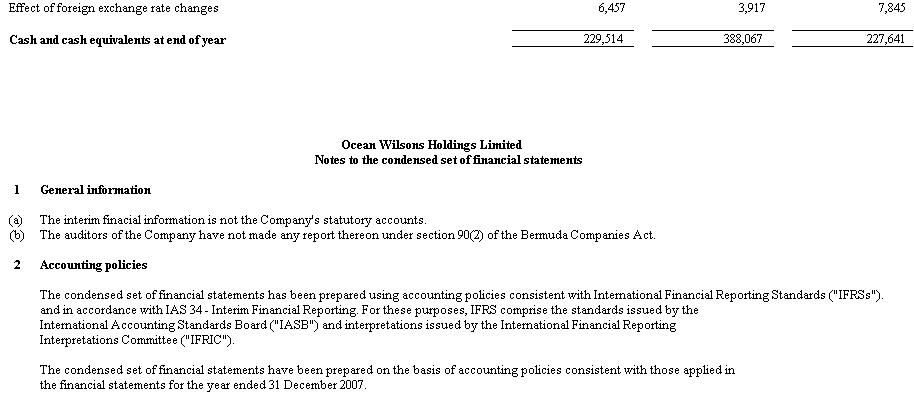

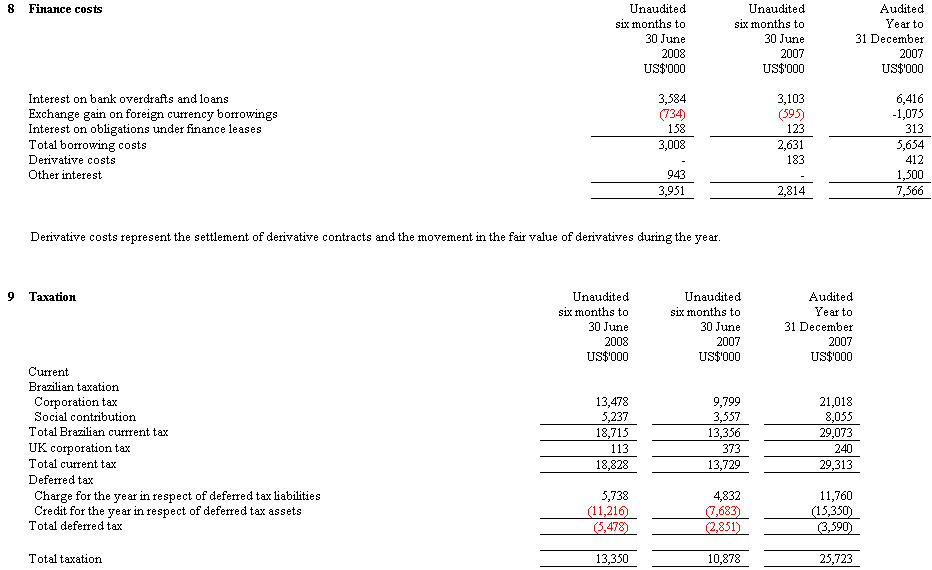

Brazilian corporation tax is calculated at 25 percent (2007: 25 percent) of the assessable profit for the year.

Brazilian social contribution tax is calculated at 9 percent (2007: 9 percent) of the assessable profit for the year.

At the present time, no income, profit, capital or capital gains taxes are levied in Bermuda and,accordingly, no provision for

such taxes has been recorded by the company. In the event that such taxes are levied, the company has received an

undertaking from the

Bermuda Government exempting it from all such taxes until 28 March 2016.

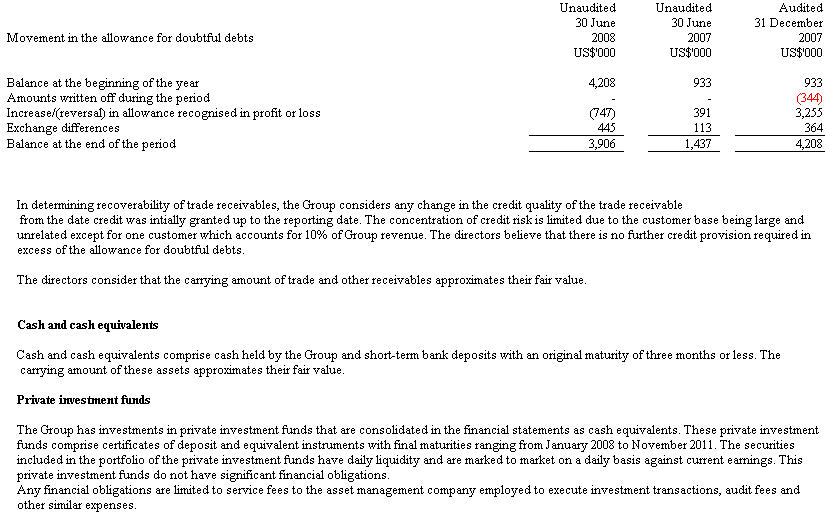

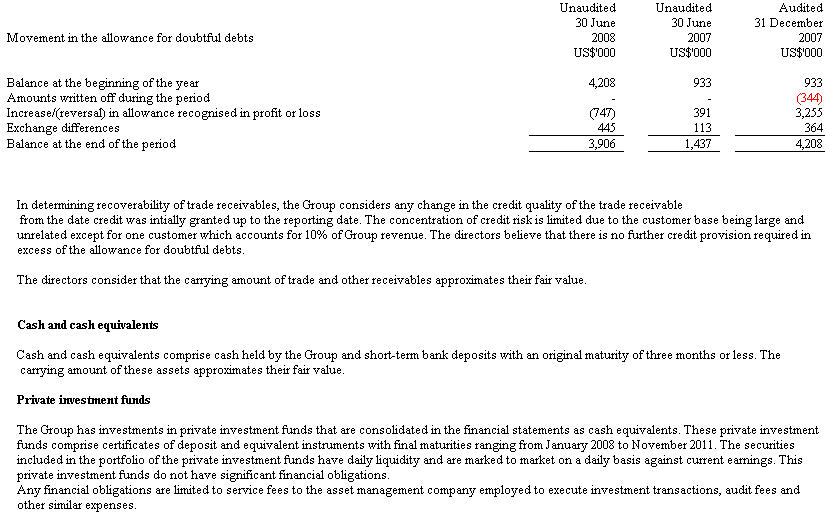

Credit risk

The Group's principal financial assets are cash, trade and other receivables and trading investments.

The Group's credit risk is primarily attributable to its bank balances, trade receivables and investments. The amounts presented

as receivables in the balance sheet are net of allowances for doubtful receivables as outlined above.

The credit risk on liquid funds is limited because the counterparties are banks with high credit-ratings assigned by international

credit-rating agencies. The credit risk on investments held for trading is limited because the counterparties with whom the Group

transacts are regulated institutions or banks with high credit ratings.

The company's appointed investment manager, Hanseatic Asset Management LBG, evaluates the credit risk on trading investments

prior to and during the investment period.

The Group has no significant concentration of credit risk, with exposure spread over a large number of counterparties and customers.

As a matter of routine, the Group reviews taxes and levies impacting its businesses with a view to ensuring that payments of such

amounts are correctly made and that no amounts are paid unnecessarily. In this process, where it is confirmed that taxes and/or

levies have been overpaid, the Group takes appropriate measures to recover such amounts. During the year ended 31 December

2007, the Group received a response to a consultation to tax officials confirming the exemption of certain transactions to taxes

which the Group had been paying through that date. This response permits the Group to recoup such amounts paid in the past

provided the Group takes certain measures to demonstrate that it has met the requirements of tax regulations for such recovery.

During the first half of 2008, the Group was able to meet such requirements and recognized US$3.7 million as a credit in the

Consolidated Income Statement for that year. The Group expect to recover further such amounts in the future, but it is not

practicable to quantify them.

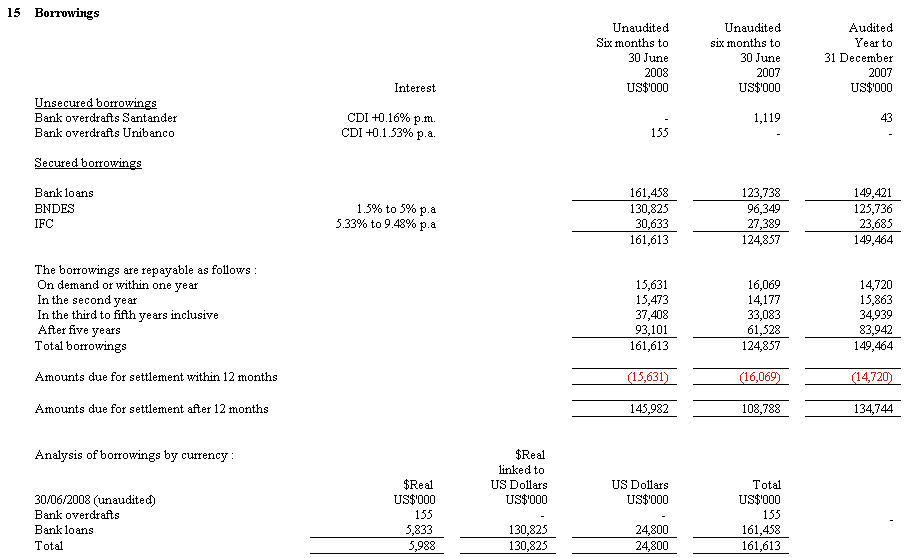

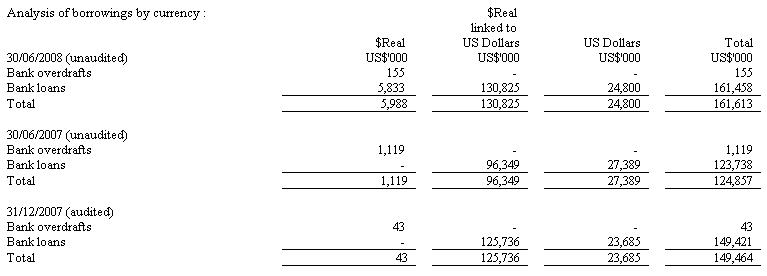

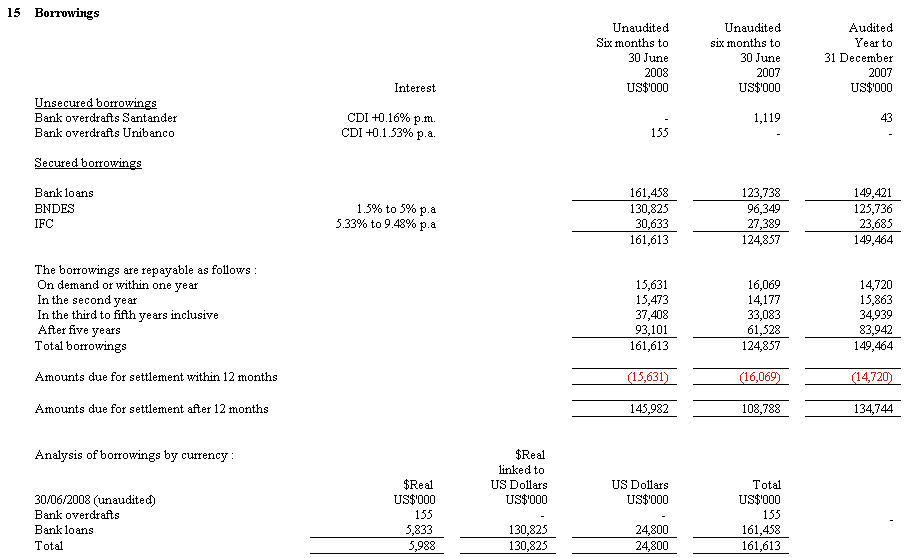

The other principal features of the Group's borrowings are as follows:

$Real denominated loans linked to the US dollar are monetarily corrected by the movement in the US dollar/$Real exchange

rate and bear interest of between 1.5% and 5.0% per annum. These loans are to finance the building of new tugs, platform

supply vessels and refurbishment of dredges and are secured by mortgages thereon. The amounts outstanding at 31

December 2007 are repayable over periods varying up to 20 years.

US dollar denominated loans bear interest at between six month LIBOR plus 3.5% per annum and six month LIBOR plus 4.15%.

The majority of these loans are project finance to fund the expansion of the container terminal at Tecon Rio Grande and have no

recourse to other companies in the Group. The amounts outstanding at 31 December 2007 are repayable over periods varying

up to 7 years.

The subsidiaries Tecon Rio Grande and Tecon Salvador have specific restrictive clauses in their financing contracts with

financial institutions related, basically, to the maintenance of liquidity ratios. At 31 December 2007, the Group is in accordance

with al clauses of these contracts.

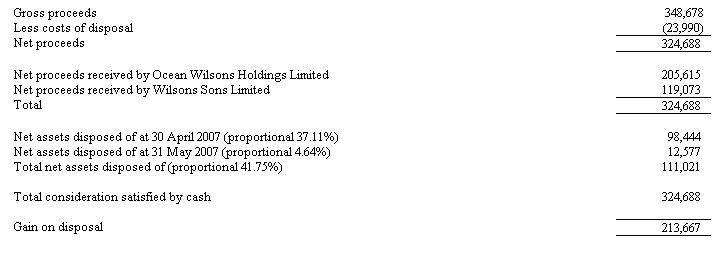

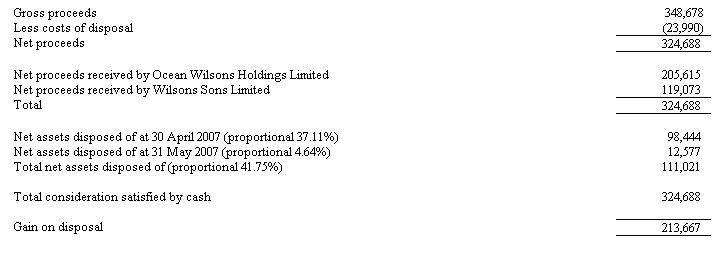

16 Disposal of minority interest

On 30 April 2007 the Group sold a 37.11% minority interest in Wilson Sons Limited

as part of the initial public offering of that company. On 31 May 2007, the Group sold a further 4.64% minority interest.

The cash consideration after transaction costs received for the total 41.75% minority interest in Wilson Sons Limited was

US$ 324.7 million.

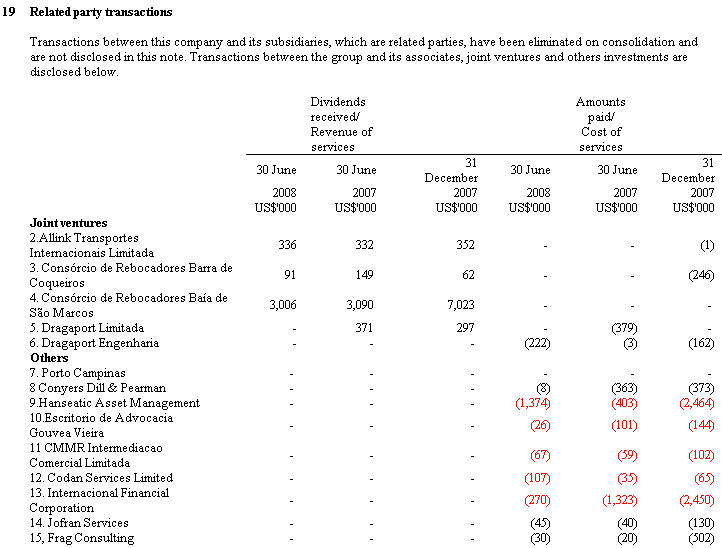

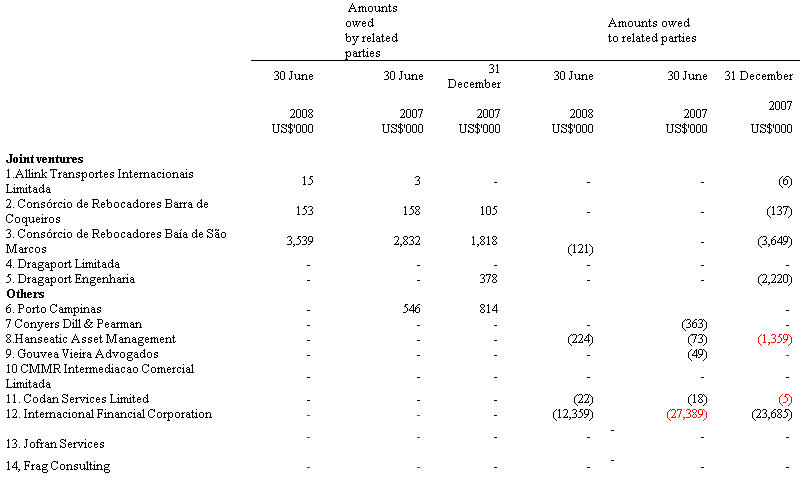

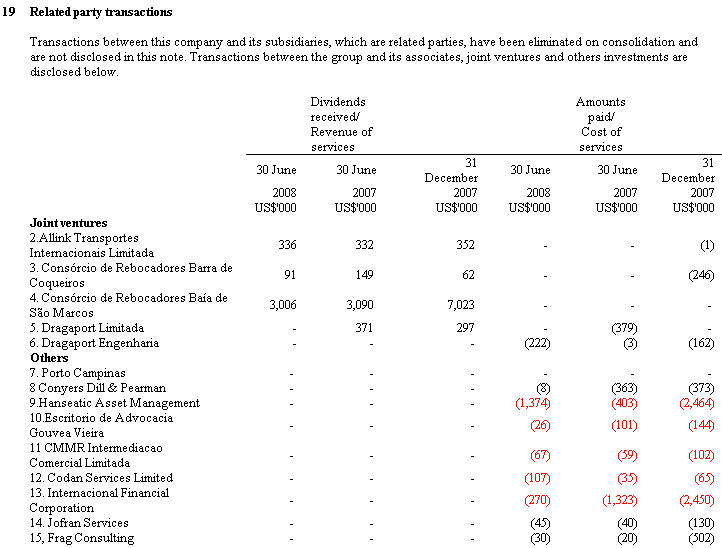

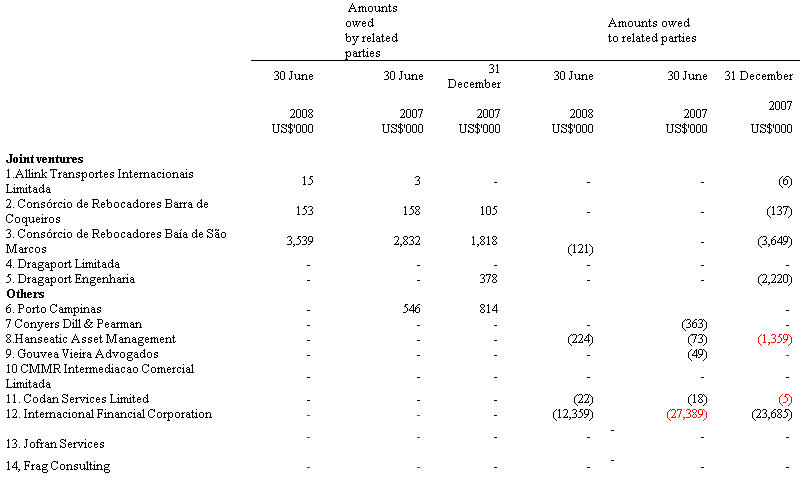

1. Mr A C Baião is a shareholder and Director of Allink Transportes Internacionais Limitada. Allink Transportes

Internacionais Limitada is 50% owned by the Group and rents office space from the Group.

2-6.The transactions with the joint ventures are disclosed as a result of proportionate amounts not eliminated on consolidation.

The proportion of ownership interest in each joint venture is described on note 17.

7. Mr C F A Cooper was a partner in Conyers, Dill and Pearman. Fees were paid to Conyers Dill & Pearman for legal advice.

8. Mr W H Salomon is Chairman of Hanseatic Asset Management. Fees were paid to Hanseatic asset management

for acting as investment managers of the Groups investment portfolio and administration services.

9. Dr J.F. Gouvea Vieira is a managing partner in the law firm Gouvea Vieira Advogados. Fees were paid

to Gouvea Vieira Advogados for legal services.

10. Mr C M Marote is a shareholder and Director of CMMR Intermediacao Comercial Limitada. Fees were paid to CMMR

Intermediacao Comercial Limitada for consultancy services.

11 Mr C F A Cooper was a partner in Conyers, Dill and Pearman during the period, the owners of Codan Services.

Fees were paid to Codan services for company secretarial services.

12. Internacional Financial Corporation (a subsidiary of the World Bank ) is the minority shareholder of Tecon Salvador S.A.

The Group has bank loans with this this financial institution.

13. Mr J F Gouvea Vieira is a Director of Jofran Services. Directors fees and consultancy fees were paid to Jofran Services.

14. Mr F Gros is a Director of Frag Consulting. Directors fees and consulting fees relating to the Wilson Sons IPO

were paid to Frag Consulting

20 Financial instruments

Capital risk management

The Group manages its capital to ensure that entities in the Group will be able to continue as a going concern.

The capital structure of the Group consists of debt, which includes the borrowings disclosed in note 15, cash

and cash equivalents and equity attributable to equity holders of the parent comprising issued capital, reserves

and retained earnings and the consolidated statement of changes in equity.

The Group borrows to fund capital projects and looks to cash flow from these projects to meet repayments.

Working capital is funded through cash generated

by operating revenues.

Externally imposed capital requirement

The Group is not subject to externally imposed capital requirements.

Financial risk management objectives

The Group's Corporate Treasury function provides services to the business, co-ordinates access to domestic

and international financial markets and manages the financial risks relating to the operations of the Group

through internal reports. These risks include market risk, (including currency risk, interest rate risk and price risk)

credit risk, liquidity risk.

The Group may use derivative financial instruments to hedge these risk exposures, with Board approval. The

Group does not enter into trade financial instruments, including derivative financial instruments for speculative

purposes.

Market risk

The Group's activities expose it primarily to the financial risks of changes in foreign currency exchange rates

and interest rates.

Foreign currency risk management

The Group undertakes certain transactions denominated or linked to foreign currencies and therefore exposures

to exchange rate fluctuations arise. The Group operates principally in Brazil with a substantial proportion of

the Group's revenue, expenses and assets denominated in the Real. Due to the cost of hedging the Real , the

Group does not normally hedge its net exposure to the Real as the Board does not consider it economically viable.

However during 2006, the Group used immaterial currency swaps to manage its exposure on the short term

position of its US Dollar and US Dollar linked debt from Real denominated cashflows.

Interest rate risk management

The Group is exposed to interest rate risk as entities in the Group borrow funds at both fixed and floating interest rates.

The Group borrows from the BNDES (Banco Nacional de Desenvolvimento Economico e Social) to finance vessel

construction. These loans are fixed interest rates loans linked to the US Dollar. Due to the favourable rates offered by

the BNDES, in the Group's opinion, there is minimal market interest rate risk. The Group's strategy for managing interest

rate risk is to maintain a balanced portfolio of fixed and floating interest rates in order to balance both cost and volatility.

The Group may use derivative instruments to reduce cash flow interest rate attributable to interest rate volatility.

As at 31 December 2007 the Company had no outstanding interest rate swap contracts.

Credit risk management

Credit risk refers to the risk that a counterparty will default on its contractual obligations resulting in a financial loss

to the Group. The Group has adopted a policy of only dealing with creditworthy counterparties as a means of

mitigating the risk of financial loss from defaults. The Group's sales policy is subordinated to the credit sales rules

set by management, which seeks to mitigate any loss from customers' delinquency. Trade receivables consist

of a large number of customers except for one large customer, which makes up 10% of revenue. Ongoing credit

evaluation is performed on the financial condition of accounts receivable.

Liquidity risk management

Ultimate responsibility for liquidity risk management rests with the Board of Directors . The Group manages

liquidity risk by maintaining adequate reserves, banking facilities and reserve borrowing facilities by continously

monitoring forecast and actual cash flows and matching the maturity profiles of financial assets and liabilities.

Fair value of financial instruments

The fair value of non-derivative financial assets and traded on active liquid markets are determined with reference

to quoted market prices. The carrying amounts of financial assets and financial liabilities recorded at amortised

cost in the financial statements approximate their fair value.

This information is provided by RNS

The company news service from the London Stock Exchange

END

![]()

![]()